REAL ESTATE

Picture isn’t all bad as incomes rise

For first-time homebuyers in Williamson County, the current housing market is a confusing one.

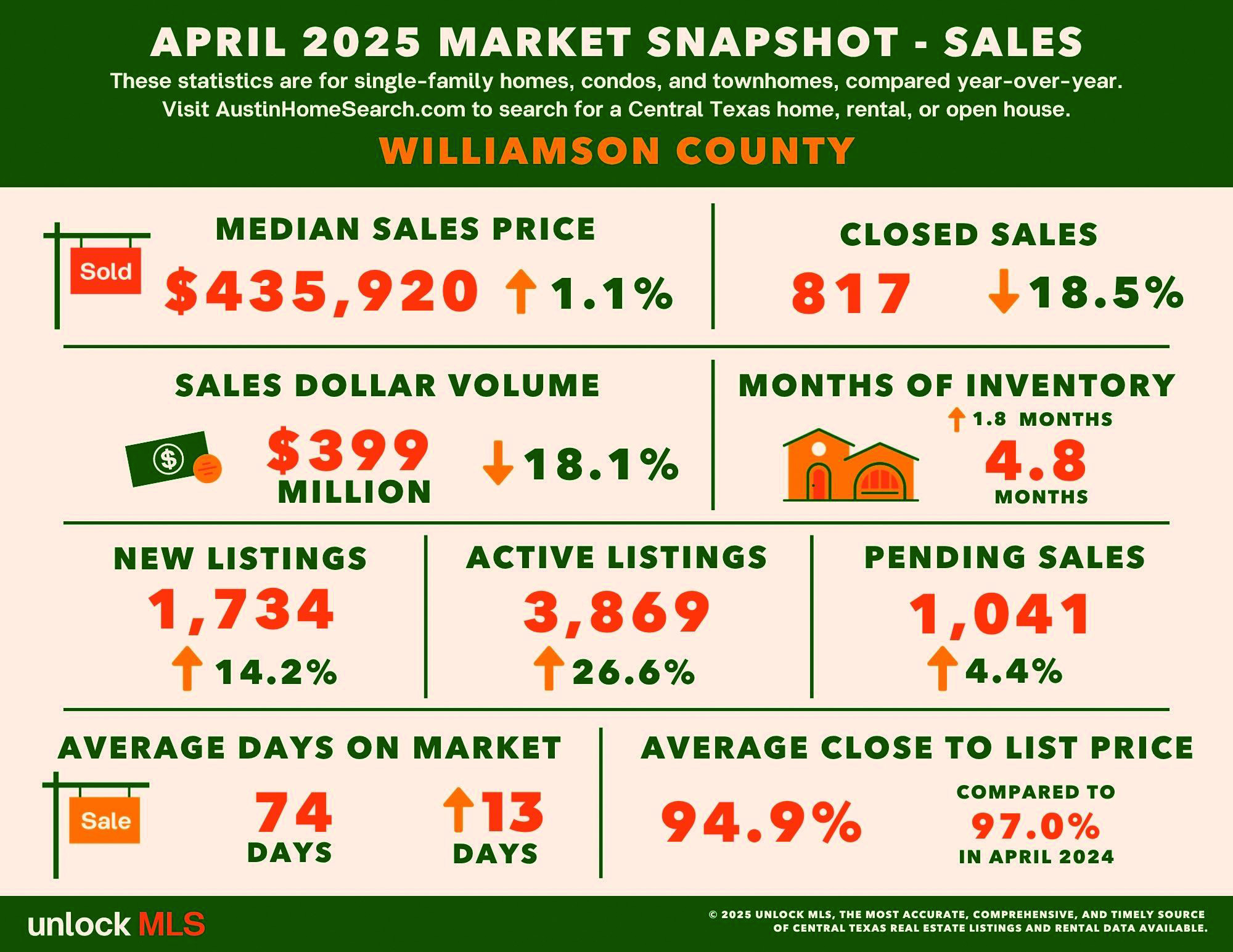

Several state, national and international economic factors have kept downward pressure on the price of a single-family house, with the outcome Williamson County remains far more affordable at a median price of nearly $436,000 in April compared to Travis County’s $520,000 and a whopping $595,000 inside Austin’s city limits.

However, interest rates have remained stubbornly high, raising monthly mortgage payments to levels that often take home ownership off the table.

As the spring and summer homebuying season began, the most active sales period of the year, Williamson County saw a 27% increase in homes on the market to 3,869 at the end of April compared to the same month last year, according to the most recent figures.

“That can be overwhelming for a buyer” with so much more to choose from, said Clare Knapp, housing economist for Unlock MLS and the Austin Board of Realtors.

The good news for those seeking a place to live in East Williamson County to be close to new jobs at Samsung Austin Semiconductor’s Taylor plant opening next year, its numerous suppliers and a host of other companies locating operations in the area is that house prices are much lower than the county’s $436,000 median price.

Housing sales in East Williamson County are down slightly in April while the price of the homes sold dropped 4% in the Hutto area to $355,000, even as Taylor-area median home prices leapt 18% to $360,000 compared to last year, according to data from Unlock MLS.

In Williamson County, inventory was up by nearly half to 4.8 months.

In the 76574 ZIP code that includes Taylor, the inventory rose to 6.6 months from 4.2 months in April 2024. Statistics for the Hutto ZIP code 78634 show that inventory doubled to 3.3 months for the same period.

A balanced market usually occurs when there are about six months of inventory available. Lower numbers make it a seller’s market and higher inventory is usually to the advantage of the buyer.

East Williamson also remains a great option for people working in Austin because of the lower prices, Knapp said.

“People are going to want to live as close as possible to work, but they want the home more than they want the shorter commute,” Knapp said.

Meanwhile, stabilization of prices is welcome after the wild ride of competition for limited inventory at the beginning of the decade, analysts said.

In general, more houses coming onto the market across the region gives buyers more choices and stabilizes prices compared to a buying boom during and immediately after the COVID-19 pandemic lockdown, according to realestate professionals.

Prices soared as buyers could afford more house thanks to record-low mortgage lending rates. The tight inventory of houses up for sale created bidding wars and set off another building boom.

Despite the stable pricing environment, April sales in the county were down 18.5% to 817 houses. Across the entire five-county Austin-Round Rock-San Marcos Metropolitan Statistical Area there were 2,484 houses sold, 13.8% fewer than the opening of the spring buying season in 2024.

A more diverse spread of houses available at lower prices is still hard to come by.

For example, just 300 houses representing 8% of the active listings in

“There are a lot of developers sitting out right now because of high rates on construction loans.”

— Kendall Garrison, Amplify Credit Union Williamson County at the end of April were priced at $300,000 and less, a price point desired by many first-time buyers.

“While this signals progress, especially for first-time homebuyers, significant work remains to improve long-term housing affordability across the region, especially as higher mortgage rates and economic turbulence impact buyer confidence,” Knapp said.

The environment for couples or young families looking for a place to call their own isn’t all bad because incomes also are on the rise, Knapp added. The median household income for a family of four in the greater Austin area increased to nearly $134,000 in 2025 from around $91,000 two years ago.

While new housing is under construction or in the planning phases for Williamson County, building has slowed from where it was at the height of the pandemic and immediate post-pandemic boom.

New building permits for singlefamily homes were at 1,600 in April for the five-county MSA with 469 permits in Williamson County, according to a breakdown of U.S. Census Bureau data by the Texas Real Estate Research Center at Texas A&M University.

That’s a decline of nearly 100 units from the same month last year.

“There are a lot of developers sitting out right now because of high rates on construction loans,” said Kendall Garrison, CEO of Austin-based Amplify Credit Union. While homebuyers balked at mortgage rates approaching 7%, developers are having to shell out up to 8.5% for loans to finance new housing starts.

Garrison said small builders – those constructing fewer than 100 houses a year – are especially impacted by the current lending climate.

“Their clients are sitting pat until interest rates come down” and they are less likely to build on speculation the house will sell quickly, he said.

A cycle of unpredictability that started with the COVID-19 pandemic to today’s uncertainty around how on-again, off-again tariffs will affect supply chains and inflation all have an impact, Garrison added.

Auto repossessions are up, as are late payments on credit card debt, he added. Add to that resumption of student loan payments and defaults on student debt and the situation looks even more dire.

“The next shoe to drop is a recession,” he said. “This is certainly a challenging time to be a first-time homebuyer.”

While a recession may hurt jobs in some sectors, it also could spur homebuying. A longer-term dip in the economy could lead to lower interest rates and initial softness in pricing. Because of that, 30% of potential homebuyers said a downturn in the economy could spur them to get off the fence and make a purchase, according to a survey by Realtor.com.

Garrison said that while there are significant downward pressures on housing prices, there are pockets where prices are up 15%. Some of that comes from unrealistic expectations on the part of the seller.

Online house-hunting platform Zillow reported that in April about a quarter of listings had price cuts, the most since 2018.

Texas’ elected officials, including Lt. Gov. Dan Patrick, have declared a crisis in affordable housing across the state as the population continues to grow and the state’s pro-business policies and incentives continue to create jobs.

Currently, however, there is less incentive for builders to build lower-cost housing. And it will take a significant amount of job growth for building to boom again.

“There was really strong job creation during COVID” and in the wake of COVID in the greater Austin area, but it has since dropped off, which created some of the softness in housing prices, Knapp said.

“You need 10% job growth month over month and year after year to move the needle on the housing market,” Knapp said.

“Significant work remains to improve long-term housing affordability across the region.”

— Clare Knapp, Unlock MLS and the Austin Board of Realtors

Comment

Comments